Democrats Are Right to Worry About Property Tax Hike

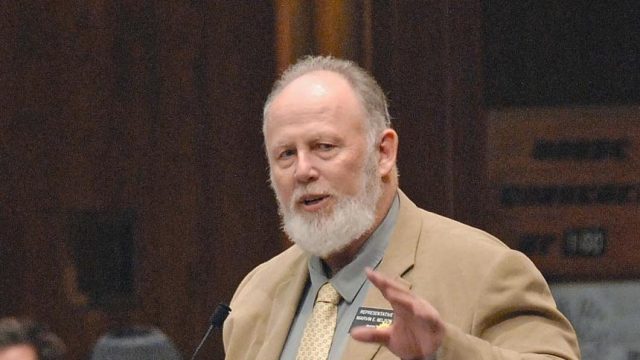

Back during his gubernatorial campaign last year Rep. Marvin Nelson (D-Rolla) warned that the state’s budget problems could result in property tax hikes.

“[T]his is shaping up to be one of the largest property tax increases that people are ever going to be able to remember in history,” he said almost a year ago. “Everyone is taking pledges saying we won’t raise any taxes and we won’t do this. But really what that just means is that they’re just going to shove it all back down on the local level.”

Nelson was right to be concerned. Democrats expressing concerns about property taxes this week are right to be concerned. Because the dirty little secret behind the “property tax relief” Republicans have been touting for years now is that it was a shell game.

A shift. A transfer of spending from local budgets to the state budget in the hopes that local governments would implement corresponding property tax reductions.

[mks_pullquote align=”right” width=”300″ size=”24″ bg_color=”#ffffff” txt_color=”#000000″]It’s quite the conundrum, and illustrates the stupidity of the Republican approach to property tax relief under Governors Dalrymple and John Hoeven before him.[/mks_pullquote]

The bulk of the “property tax relief” Republicans passed under former Governor Jack Dalrymple was in the form of school spending. The state took over a much larger share of school funding, shifting that burden to state tax revenues and away from property taxes. With lawmakers avoiding K-12 education cuts, thanks to the Foundation Aid Stabilization Fund (a piggy bank created for just that sort of thing), that’s not going to change.

But at risk is that 12 percent property tax buy down the state has created. If the state stops the buy down locals will almost certainly respond with property tax hikes.

Governor Doug Burgum addressed this in January when he released tweaks to Dalrymple’s executive budget for this session. His version of the budget called for an end to the 12 percent buy down, but compensated for it by shifting responsibility for funding social services from the counties to the state.

Which was probably the best way to handle a bad situation. But now the bill moving social services into the state budget has been turned into a study, and the 12 percent buy down is on the chopping block.

If lawmakers do neither, Nelson’s prediction about local property tax hikes will come true.

It’s quite the conundrum, and illustrates the stupidity of the Republican approach to property tax relief under Governors Dalrymple and John Hoeven before him. It was politically expedient, back when we had a tidal wave of revenue from oil activity and high crop prices, to deal with the sticky property tax issue by hiding it in state budget surpluses.

But now those surpluses have evaporated, the problem has re-emerged, and we have two bad choices in front of us. We can leave the spending in the already tight state budget, putting upward pressure on state taxes, or we can send the spending back to the locals and watch them respond with property tax hikes.

Many political observers, including this one, have been warning for years now about a day of reckoning for this inane decision to implement tax relief by way of spending.

Well it seems that day is upon us, with only bad choices in front of us, and the only people Republicans have to blame is themselves.