Pennsylvania pension costs to climb by $466 million next year

By Eric Boehm | PA Independent

Lawmakers and governor-elect Tom Wolf will head into next year’s budget process with lots of new obligations to fulfill and little excess revenue with which to do it.

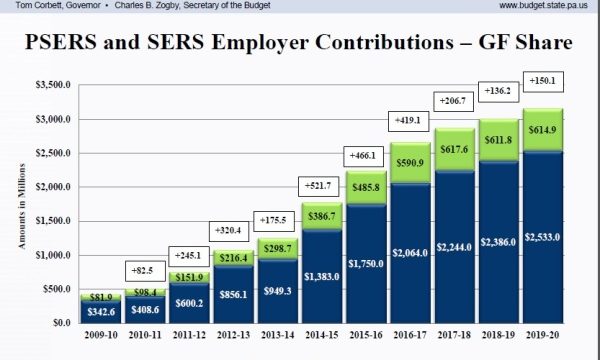

State-level contributions to Pennsylvania’s two pension plans will have to climb by an estimated $466 million in the next budget, after an increase of about $520 million this year. Next year could be considered the mid-point of a decade-long “pension spike” that sees retirement costs consuming larger and larger shares of the state’s spending each year.

GETTING WORSE: The state budget will continue to be squeezed by increasing pension costs.

Budget Secretary Charles Zogby of Gov. Tom Corbett’s outgoing administration outlined the bad news this week in an annual mid-year update on the state’s fiscal situation.

After four years of seeing pension costs grow — the state spent about $500 million on pensions in the last budget before Corbett took office, compared to more than $1.7 billion this year — and making limited headway on any changes to how the state pays for its employees’ retirement, the governor’s team will soon hand responsibility to Wolf.

The governor-elect ran on a campaign promise to increase funding for schools. Before he can do that, he’ll have to find a way to make budgetary ends meet.

“I want to make sure that we have a sense of how serious this problem is,” Wolf said. “I want to make sure we’re all in agreement that I’m inheriting a big problem here.”

Pensions are the biggest part of the problem, but mandatory cost increases in other parts of the budget and a minuscule (by state government standards) $1 million expected revenue surplus are putting Pennsylvania on the path to an expected $1.8 billion deficit next year, according to Zogby and the state’s Independent Fiscal Office.

Wolf promised to find innovative solutions to the budgetary problems and growing pension costs, though details will have to wait until his transition team has completed their assessment of the mess, he said.

He also laid the blame at the feet of the Corbett administration, which has spent the past four years doing plenty of finger-pointing of its own.

Both can get away with it because the pension crisis has its roots in a series of decisions made by three different governors and state legislatures between 2001 and 2003. A series of changes to the pension plans increased benefits without asking state workers to contribute more towards retirement, boosted retirement benefits for those who were no longer working at all and allowed the state to take a decade-long “pension holiday” without paying for those increased costs.

That pension holiday ended in 2011, leaving first Corbett and now Wolf holding the bag.

Corbett’s administration stuck to its no-new-taxes plan and used budget cuts to pay for mandatory pension increases.

Wolf promises to take a different approach, though on Wednesday he didn’t say whether higher taxes would be necessary.

“We need to meet the promises, keep the promises we make,” Wolf said during a Wednesday press conference. “Part of what we’re doing now is making up for, I think, a failure to keep up with pension contributions back when we should have been making them.”

The one thing he won’t do, Wolf said, is delay benefit payments to retired state workers.

Some Republicans in the state Legislature have sought an overhaul of the state pension system for the past two years, but neither chamber has passed a bill to make serious changes.

Even if some long-term costs of the system were reduced by changing the retirement benefits for future hires or current employees, the costs that are squeezing the budget this year and for the immediate future are mostly due to retirees. Their benefits are locked in place and little, if anything, can be done to change them.