Absence Of Profit Motive Is Exactly What's Wrong With Student Loans

Senator Heidi Heitkamp is on a statewide tour aimed at ingratiating herself with college students by talking about the student loan issue. In the Senate Heitkamp has opposed introducing some market forces to the heavily-inflated student loan market,and here in North Dakota she’s seemingly arguing against any sort of market forces for student loans.

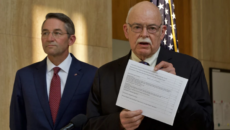

“Everybody understands the drag that student debt is on the economy. Everyone understands that college needs to be more affordable. Everyone I hope believes that we should not be making money on the backs of students,” said Heitkamp at a recent meeting at UND. “And so when we start out with those three principles I think that we can solve this problem if we just work together.”

Boring, meaningless platitudes aside, the fact that student loans have essentially become an entitlement is exactly why we have a student loan bubble. It’s also why college has become so affordable.

Back when banks were profiting directly from student loans, there were lending standards. Things such as GPA and the desired area of study were considered before an institution would finance a college education. Today, with student loans essentially nationalized and the federal government backing the loans, the funds are lent indiscriminately.

This has inflated demand for college, which has in turn inflated tuition (and contributed to an epidemic of lavish campuses and sumptuous compensation for university bureaucrats) and created the higher education bubble that Heitkamp and others are at least acknowledging.

The problem is that politicians like Heitkamp are promoting more of the same as solutions.