Wealthiest pay Badger’s share of taxes in Wisconsin

By Ryan Ekvall | Wisconsin Reporter

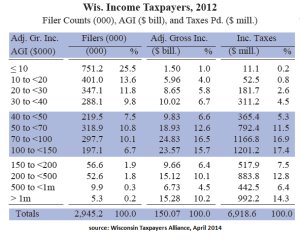

MADISON, Wis. — The top 0.5 percent of income earners in Wisconsin paid more than a fifth of the state’s income taxes in 2012.

Those 15,200 taxpayers paid $1.435 billion in income taxes, an average of $94,400 each, which is more than the annual incomes of 80 percent of the tax filers in Wisconsin, according to a new analysis from the Wisconsin Taxpayers Alliance.

Wisconsin’s “progressive” income tax structure means the wealthiest few carry the burden of government for the rest of the state. The top 0.5 percent of income earners made 14.7 percent of the state’s income, but paid nearly 21 percent of all state income taxes. And Wisconsin’s tax structure until 2013 has been among the most progressive in the country.

State Rep. Dale Kooyenga, R-Brookfield, has in the past two sessions of the Legislature led a Republican effort to flatten the income tax in Wisconsin. Gov. Scott Walker signed income tax reduction for all earners in 2013 and an additional cut for the lowest income earners in 2014.

Despite the work, the state now taxes top earners’ income at 7.65 percent, a mere .10-percent reduction from the previous 7.75 percent rate. The rate is 4 percent for lower income earners.

“Higher and more progressive tax codes have a negative effect on labor,” said Lyman Stone, an economist at the Tax Foundation. “It’s not devastating, but when you know working overtime or putting extra investment in your education is going to have a lower return than what you already put in, it’s a disincentive.”

Stone noted Wisconsin’s tax structure has moved toward the middle after the Republican-led reforms.

Still, nearly two-thirds of Wisconsinites in a recent Marquette Law School poll said they’d support increasing income taxes on those making more than $250,000 to fund a property tax cut.

Or as The Capital Times, Madison’s leftist newspaper, recently put it:

“While the public strongly backs higher income taxes on upper incomes, do you think Gov. Scott Walker would ever stand for even modest increases on the highest compensated among us, many of whom make up his core Republican constituency, his most ardent fans and biggest donors?

“Right, when pigs fly.”

But there’s a practical reason to flatten the income tax.

The Federal Reserve Bank of Kansas City explained that tax “structures that are more progressive … will experience faster growth and more volatility in revenues.”

Wealthier people’s incomes tend to be more volatile than lower income earners. In a down economy, the wealthy may not receive a bonus or close as many sales. That means when the economy goes bust, so do Wisconsin’s budget forecasts.

“When you have a revenue system that’s dependent on more erratic incomes, the result is unstable revenues,” Stone said. “During the boom years you expand spending, you introduce new government obligations. When bad times come, you have a disproportionately steep revenue fall, and you have liabilities you can’t afford anymore.”

That should sound familiar to Wisconsinites.

Walker floated the idea late last year of abolishing the state income tax. Supporters argued when all things are equal a tax on goods or services mean less goods and services are produced.

Contact Ryan Ekvall at rekvall@watchdog.org, 608-257-1382 or follow him on Twitter @Nockian.