Vermont deer camp owner wins property tax victory

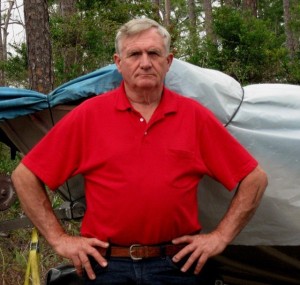

FED-UP: Tom Chase drove his Ford F-350 1,340 miles across the Green Mountain State, visiting 19 towns, to find out his property is worth far less than what the town of Townshend claimed.

By Bruce Parker | Vermont Watchdog

TOWNSHEND, Vt. — The owner of a rustic unoccupied deer camp in Vermont won a property tax victory over town listers after an appeal to the state exposed a flawed, highly suspicious assessment of his property.

In 2013, Tom Chase, the owner of the hunting camp located on 27 acres in Townshend, learned that a townwide reappraisal had raised his property’s assessed value from $74,000 to $94,000, sending his property taxes up 124 percent overnight.

While an appeal to the local Board of Civil Authority produced only a modest adjustment to $91,400, a property tax hearing officer at the state Department of Taxes last month ordered that Chase’s land be set at $68,000 in the grand list book, in keeping with its fair market value.

The state hearing officer identified major flaws in Townshend’s handling of the assessment.

“The hearing officer finds that no sales to support fair market value in a direct comparison were offered by the town,” Norman Wright, the hearing officer, wrote in a four-page decision dated Sept. 22.

Not only did Townshend’s listers fail to provide relevant comps showing the basis for their action, but they failed to provide the appraiser for questioning, according to Wright.

“Neither the appellant or the hearing officer was able to question him as to the data he employed in estimating the property’s market value.”

The decision says the town offered only a group of land sales plus some large lot sales in Windham County, which had no direct comparison to Chase’s property.

In his appeal, Chase provided comparable sales from across the state identified by Springfield realtor Barrett & Valley Associates. Determined to find what his property was truly worth, Chase, 74, drove his Ford F-350 1,340 miles across the Green Mountain State to gather information on each of the properties. The comps ranged between $60,000 and 70,000.

Wright concluded that the statewide comps showed the property’s true valuation: “I find the market and assessed value to be $68,000 in line with the comparables of similar size offered by the appellant.”

Chase told Vermont Watchdog he was generally pleased with his victory, but he blasted Townshend’s handling of the reassessment.

“The Board of Civil Authority are constables, listers, the town clerk and selectmen who know nothing about nothing. It’s a time consuming, frustrating farce,” he said.

“The listers and BCA members disregarded all my data on properties sold in the state — which by court order Ames v. Danby I can have — establishing fair market value. The state appraiser honored my data. Listers and the BCA have only one thing in mind: get money for the town.”

A HOMESTEAD?: This never-occupied deer camp, which has no electric, water or sewage, lies at the center of a property-tax dispute in Townshend, Vt.

The state appraiser found other flaws in the valuation of Chase’s property. For example, the BCA committee report said the camp was wired, but Wright’s visit discovered the wiring was a single line between an inoperable outside generator and three basement light bulbs. The cabin’s three-room main floor has no wires.

Also at issue was the unoccupied deer camp itself. The 564-square-foot dwelling has no water, sewage or electric, yet listers classified it as a “homestead,” giving it a status as a lived-in residence.

The state appraiser disagreed: “The property is not a homestead property and is utilized as recreational and forest land. The highest and best use is as recreational and forest land.”

Chase was not entirely satisfied with the outcome of the decision, however.

His unusable fireplace has a value set at $2,275, an unusable well with no accessible water is valued at $1,500, and a basement entrance that cost Chase $75 is valued at $1,125. Moreover, two acres on which the dwelling sits are given a higher value of $22,000, simply because the town says those acres are “developable.” The other 25 acres altogether were valued at $22,696.

“If I’m not going to develop, why the higher value? They are taxing on potential,” Chase said.

The state’s decision has been sent to Townshend’s town clerk for recording in the grand list book. Chase has 30 days to make any further appeals, which must be filed with the Vermont Supreme Court along with a filing fee of $265.

Contact Bruce Parker at bparker@watchdog.org