The Tom Wolf income tax plan: What we know, and what we don’t

By Eric Boehm | PA Independent

Four years ago, Pennsylvanians went to the polls and elected Tom Corbett their 46th governor.

At the center of Corbett’s campaign platform was a simple promise about taxes — a pledge not to raise them.

On Nov. 4, voters will again have to pick their governor, and if the pre-election polls are any indication, the result will be a comfortable win for a different Tom with a very different proposal when it comes to taxes in the Keystone State.

Tom Wolf is promising to raise them.

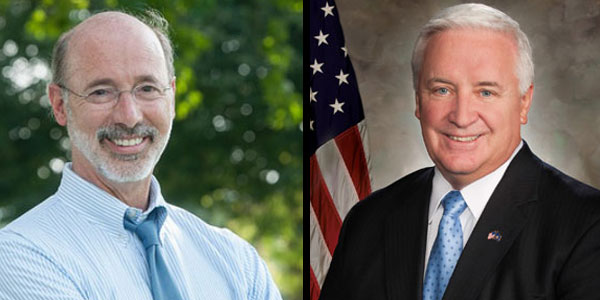

OF TOMS AND TAXES: Tom Wolf, left, the Democratic candidate for governor in Pennsylvania, wants to hike the income tax rate to make the rich pay more to support new education initiatives. Tom Corbett, right, the Republican incumbent, has spent four years touting his opposition to tax increases.

Based on details he’s sketched out so far, taxes won’t increase for everyone, and it might not happen right away, but Wolf has not shied away from putting a revolutionary tax plan at the center of his campaign.

Here’s what we know about Wolf’s plan, as he’s described it in three gubernatorial debates and published accounts from editorial board meetings with Pennsylvania newspapers: Wolf says he would do away with Pennsylvania’s current income tax system, in which all residents of the state pay a flat 3.07 percent, replacing it with a progressive tax scheme that would see those making more than $70,000 potentially paying more while cutting a break for those below that threshold.

“Under (Wolf’s) income tax plan, people at the top will pay more and the middle class will get a break,” campaign spokeswoman Beth Melena told PA Independent.

Because the state constitution forbids placing people into tax brackets with different rates – like the federal income tax system – Wolf would have to raise the income tax rate for all Pennsylvanians, then offset the increase by creating a new tax break, which his campaign is calling a “universal exemption,” for low-income people.

But the overall goal is to raise revenue for the state to spend.

Wolf wants to re-route how education funding works so that every school district in Pennsylvania gets at least half its annual budget from the state. He wants to spend more subsidizing higher education for Pennsylvania students and wants to provide universal pre-kindergarten classes.

Increases in the income tax would pair with reductions in local property taxes as the state took on a larger share of education costs, Melena said.

Equally important is what we don’t yet know: Would married couples have to file separate returns to take advantage of the $30,000 individual exemption, or would they get a special $60,000 exemption?

And how much would the income tax have to increase to provide for all the education programs Wolf has proposed?

Wolf has sent mixed messages on the marriage question – at one time claiming that couples would have to file separate returns so each individual could take advantage of the exemption but later indicating they would be able to file jointly and still get the combined tax break.

This week, Melena told PA Independent the plan would feature “a single rate and a single exemption for all taxpayers.”

But the silence on some key details — like what the state’s new income tax rate should be — has become a focal point for Corbett, as he tries to close a double-digit gap in polling during the campaign’s waning days.

TAX TRADE-OFF: Wolf wants more education funding to flow through Harrisburg, so the higher income tax would offset much-maligned local property taxes. But one analysis says income taxes would have to increase by as much as 188 percent for high-earners, under Wolf’s plan.

“Do you want somebody who has yet to answer how much he wants to tax you and how much he wants to spend?” Corbett asked rhetorically while sharing a stage with Wolf on Oct. 8 at the third and final gubernatorial debate.

The Commonwealth Foundation, a free market think tank based in Harrisburg, did the math on Wolf’s education spending plans and concluded that Pennsylvanians making more than $80,000 annually would have to pay a tax rate of 8.85 percent — 188 percent higher than the current 3.07 percent income tax rate — to support the estimated $4.6 billion in new spending Wolf is proposing.

Chris Pack, spokesman for the Corbett campaign, cited those numbers Tuesday and argued such a tax increase would hurt Pennsylvanians’ wallets.

“Tom Wolf is doing everything in his power not to discuss his income tax plan because it means tripling the income tax rate,” Pack said.

The Wolf campaign did not refute the Commonwealth Foundation figures when asked about them this week, but he has maintained accurate projections of future tax rates won’t be possible until next year’s budget cycle.

“If Tom Wolf is elected governor, there is absolutely no way to tell what holes he will have to fill left by Governor Corbett,” Melena said. “(Wolf) does not have access to the state’s dismal financials to be as specific as you expect him to be.”

Wolf has not had to talk much about specifics during this campaign, which has always been a referendum on Corbett’s first four years in office. In campaign ads, fundraising messages and debates, the Wolf campaign and its Democratic allies have kept the focus on what Corbett has done rather than what Wolf would do.

But that doesn’t mean Wolf has tried to hide his idea for revamping Pennsylvania’s tax system. It’s spelled out in black-and-white on page 9 of the “Fresh Start” plan.

Like the name of the plan suggests, this is really just the start.

If Wolf wins, he’d have a tough time selling a progressive income tax to the Republican-controlled General Assembly, but nothing is impossible.

If Corbett wins, taxes might be going up anyway. In interviews and during debates, the governor has indicated he might not strictly adhere to the “no-tax pledge” he signed during the primary campaign in 2010, particularly because he wants to spend the next four years finding a pay to pay down the state’s $50 billion pension liability.

That pledge has been a central part of Corbett’s first term in office. He’s technically violated the letter of the pledge on three occasions: signing into law a new “impact fee” paid by gas drillers, giving his Department of Revenue greater leeway to pursue taxes from online retailers doing business in Pennsylvania and successfully pressuring the Legislature to approve a $2.1 billion transportation spending plan funded by higher gasoline taxes.

But he has generally lived up to the spirit of it by forcing the annual budget debate to keep spending in-line with current revenue, a frequent refrain from Corbett administration officials.

Corbett has little to lose by abandoning the pledge if he wins re-election; he wouldn’t have to face the voters again.

But if Wolf wins, we’ll probably get some concrete answers in early March, when he would have to present his first budget proposal to the General Assembly. Wolf told the Pittsburgh Post-Gazette last week he “hopes” to have a tax proposal ready to roll by then, but he can’t commit to any timetable until after he gets into office.

Coming tomorrow in Part 2: The pros and cons of a progressive income tax instead of a flat tax