Study shows Wisconsin’s improved fiscal condition

By Ryan Ekvall | Wisconsin Reporter

Madison, Wis. — Republican lawmakers in Wisconsin stopped just short of taking victory laps around the halls of the state Capitol last week after the Legislative Fiscal Bureau projected a $1.04 billion general fund surplus over the two budget years.

This news comes just six months after Gov. Scott Walker signed the second Republican-led budget in his tenure. While unpopular with Democrats, Walker’s fiscal reforms continue to pay dividends to state taxpayers.

Lawmakers now routinely debate how to cut taxes instead of how to raise more revenue, something unthinkable just three years ago when the state faced a $3.6 billion budget deficit.

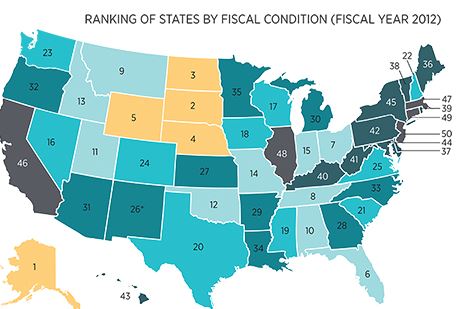

The state’s overall fiscal health is reflected in a new study ranking Wisconsin 17th among the 50 states. The study by Sarah Arnett, an economist at the Mercatus Center at George Mason University, puts the Badger State ahead of Iowa (18th), Michigan (30th), Minnesota (35th) and Illinois (48th).

IMPROVED FISCAL HEALTH: A study of the relative fiscal health of all 50 states ranks. Wisconsin ranks 17th.

Wisconsin ranked fourth in the country in “budget solvency,” far ahead of fifth place Utah on the index, one of Arnett’s four measures of overall fiscal condition. Wisconsin ended fiscal 2013 with a $760 million surplus.

Along with budget solvency — a state’s ability to raise enough revenue to cover spending over a fiscal year — Arnett calculated the states’ cash solvency (their ability to pay bills in the near term), long-run solvency (covering all its future liabilities, such as public pensions) and service-level solvency (the ability to provide adequate services to residents.)

Wisconsin ranked 35th in service-level solvency, 38th in long-run solvency and 43rd in cash solvency.

Dale Knapp, a researcher at Wisconsin Taxpayer’s Alliance, said the state can improve on those long term metrics, “by undoing some of the fiscal gimmicks we’ve employed over the past 10 to 15 years in shifting payments from one fiscal year to the next.”

Knapp said decreasing the Generally Accepted Accounting Principles deficit, which is currently at about $1.7 billion, would not only provide citizens a more transparent and honest accounting of state finances, but could cost taxpayers less money in the future due to an improved borrowing climate.

“To the extent that we permanently reduce that GAAP deficit, bond analysts will look at that positively and possibly improve the state’s bond rating, which has been among the worst in the country for the past decade or so,” Knapp said.

In practice, that might look like making changes to income tax withholding tables so workers send less to Madison over the year and receive less in tax refunds. Or paying for increased property tax credits in the same fiscal year, rather than moving it to the next year.

Walker and several other legislative Republicans campaigned on reducing the GAAP deficit and using GAAP accounting to balance the state’s books. The current GAAP deficit is down from $2.9 billion when Walker took office.

The budget watchers over at the Wisconsin Taxpayer’s Alliance have previously highlighted a need to bolster the state’s rainy-day fund, which sits at around $300 million after consecutive years of nine-figure deposits.

Knapp said that statutorily, half of any realized surplus will be deposited into the state’s rainy day fund until the fund reaches 5 percent of spending — about $750 million.

Walker has said he’ll unveil his plans for the projected surplus at his State of the State address later this week.

To view Arnett’s study click here.

Contact Ryan Ekvall at rekvall@watchdog.org, 608-257-1382 or follow him on Twitter @Nockian.

The post Study shows Wisconsin’s improved fiscal condition appeared first on Watchdog.org.