Senate housing bill would damage 20 percent of the U.S. economy, finance experts warn

By Chris Butler | Tennessee Watchdog

NASHVILLE — Tennessee U.S. Sen. Bob Corker, a Republican, is pushing for legislation creating a federal entity to regulate the housing market, six years after the government’s subprime loans nearly tanked the U.S. economy.

But is it a good idea?

Two experts, one a Franklin-based financial adviser, the other a Heritage Foundation research fellow, oppose housing finance reform legislation from U.S. senators Tim Johnson, D-S.D. and Mike Crapo, R-Idaho — but for very different reasons.

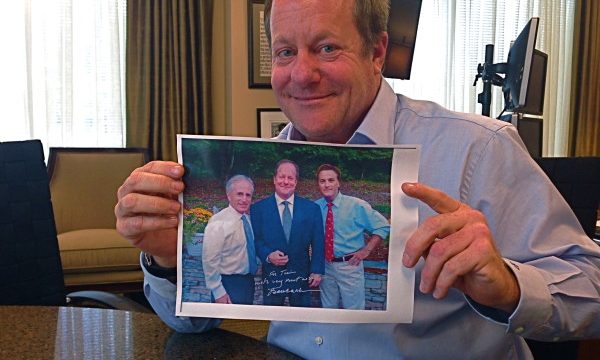

PHOTO FINISHED: Tennessee financial adviser Timothy J. Pagliara holds a photo of himself standing next to U.S. Sen. Bob Corker (far left) at a political fundraiser. Standing on the far right is Christian musician Michael W. Smith.

Johnson’s and Crapo’s legislation, which they’re calling Housing Finance Reform, evolved from legislation previously introduced by Corker.

Tim Pagliara, who said he donated $7,000 to Corker’s U.S. Senate campaign and once had direct access to the senator, calls the legislation “residential Obamacare,” which, if passed, will raise mortgage rates.

“I like Bob Corker, but I’m mad at him because he’s a blockhead and he won’t listen to me. He’s also spent too much time in D.C.,” said Pagliara, chairman and CEO of CapWealth Advisors.

“The media never writes about planes that don’t crash, so I’ve got to make an impact and I’ve got to get the facts out on the table. It’s not exciting stuff, but I don’t want people to wake up after this legislation has passed and realize their mortgage rates are going to be higher.”

So what, precisely, does this legislation do?

A Federal Mortgage Insurance Corporation, modeled after the FDIC, would regulate the new system and include a reinsurance fund to protect taxpayers, according to the legislation.

The housing market, the legislation adds, accounts for nearly 20 percent of the U.S. economy.

A board of five members, appointed by the president and confirmed by the U.S. Senate, will manage the FMIC, the legislation said.

In an emailed statement, Corker suggested to Tennessee Watchdog that Pagliara and others have an ulterior motive for speaking out against this legislation.

“There are some entities that are doing everything they can to distort the truth and kill efforts to reform the housing finance system because they benefit more from the status quo at the expense of taxpayers,” Corker said.

“Fannie and Freddie would not generate one dime of revenue without the government backstop, and I do not believe we should conflate private investors’ investment concerns with the importance of enacting sound housing policy in our country.”

Pagliara said 270 of his clients invested in Fannie Mae and Freddie Mac on his advice between 2008 through 2009.

But Pagliara said Fannie and Freddie need reform, not elimination, particularly given past government pressure for high-risk subprime loans, which led to the 2008 economic collapse.

Norbert Michel, with the Washington, D.C.-based Heritage Foundation, said he’s studied the legislation and has argued against it.

FANNIE MAE: New legislation would, if passed, eliminate Fannie Mae and Freddie Mac as a government sponsored entity in home loan mortgages.

Unlike Pagilara, Michel said he’s opposed because he wants all GSE’s eliminated, including Fannie Mae and Freddie Mac. He says the government should not replace them, period.

“We don’t believe there should be an explicit guarantee in the market for housing, just as we don’t believe there should be an explicit government safety guarantee for any markets,” Michel told Tennessee Watchdog.

“You’ve already got enough regulators. You’ve already got an FDIC. Now you’re going to create something similar to it just for the housing market. It literally creates a new federal financial safety net, which is exactly the wrong direction that we should be going. It’s just really a continuation of the direction that we’ve been going and for quite a while.”

Additionally, getting government involvement out, Michel added, would not hurt the U.S. housing market.

“No matter what happens, you’ve got a 65 percent homeownership rate. If you get rid of the GSE’s right now, you don’t take all those people who are in their homes and throw them out on the street,” Michel said.

“Not a single thing happens to those existing mortgages.”

Pagliara said he strongly disagrees with Michel, but the two men agree that nothing will happen between now and the end of the year.

The bill’s fate may rest with whichever party wins control of the U.S. Senate next month, Pagliara said.

Contact Christopher Butler at chris@tennesseewatchdog.org

Follow Tennessee Watchdog and receive regular updates through Facebook and Twitter

Like Watchdog.org? Click HERE to get breaking news alerts in YOUR state!