Sales taxes continue to rise in Alabama

By Johnny Kampis | Watchdog.org

CULLMAN, Ala. — It’s not your imagination. Sales taxes have gone up.

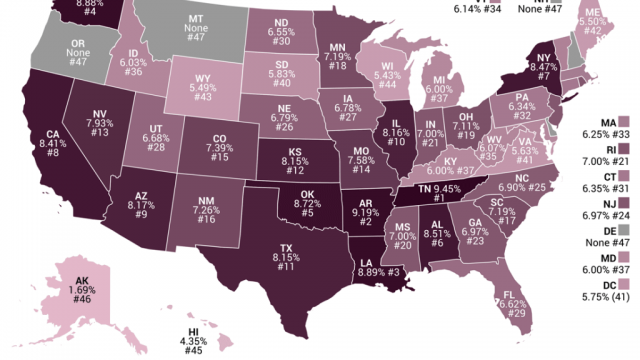

A recent report from the nonpartisan Washington, D.C.-based think tank Tax Foundation shows that Alabama has the sixth highest average sales tax burden in the United States at 8.51 percent.

The Yellowhammer State ranked eighth in the March 2013 study with an average rate of 8.33 percent.

Why the increase? While the state’s sales tax rate of 4 percent hasn’t changed, local jurisdictions are charging more sales taxes to fund their budgets. The average local tax rate of 4.51 percent is the second highest in the nation, trailing only Louisiana.

Last year, the average local tax rate in Alabama was 4.33 percent.

Tax Foundation policy analyst Scott Drenkard noted in the report that sales tax avoidance is common in some areas where there is a great disparity in sales tax rates, but that’s not likely to occur as much in Alabama. That’s because southern states generally have higher sales tax rates — in fact, Tennessee, Arkansas and Louisiana rank one, two and three for overall rates.

On the flip side, residents of Alabama — and several other southern states — enjoy lower property and income taxes.

Drenkard noted that sales taxes are among the most transparent method of collecting government revenue.

“While graduated income tax rates and brackets are complex and confusing to many taxpayers, the sales tax is easier to understand: people can reach into their pocket and see the rate printed on a receipt,” he wrote.

Contact Johnny at johnny.kampis@franklincenterhq.org.