Payroll deductions help fund school levy campaigns

By Maggie Thurber | for Ohio Watchdog

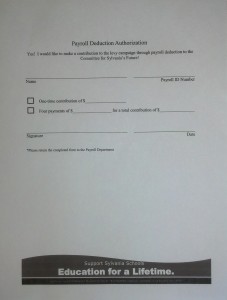

PAYROLL FORM: Using school email accounts, the Sylvania Schools distributed this handy payroll deduction form to help make it easier for staff to contribute to their school levy campaign.

Allowing teachers and administrators to contribute to school levy campaigns isn’t illegal, though many Ohioans might be surprised the practice exists.

Instead of writing a separate check, school employees fill out a form authorizing the deduction and, voila, they’re donating to the levy campaign. The district processes the deduction and forwards a check for the total to the campaign committee.

Thing is, districts aren’t allowed to use school resources to promote their levy campaigns — says so in Ohio Revised Code 3315.07:

“… (N)o board of education shall use public funds to support or oppose the passage of a school levy or bond issue or to compensate any school district employee for time spent on any activity intended to influence the outcome of a school levy or bond issue election.”

Not to worry. To get around this prohibition, districts charge a nominal fee to the employees to cover the cost of processing the deduction.

That’s what happened in the Sylvania City School District in northwest Ohio, which placed a 3.8 mill levy on the May primary ballot. It failed and the school board decided against another levy on the ballot in November.

According to the school district’s bylaws and policies, payroll deductions are only allowed for:

- federal and state income tax

- Social Security or retirement contribution

- municipal income tax

- School Employees Retirement System

- Section 125 deductions (cafeteria plans)

- State Teachers Retirement System

- Sylvania City Schools Employee Credit Union

- United Way and the Academic Excellence Foundation

- payment of dues of unions representing Sylvania schools employees

- payment for benefits of part-time employees who elect to participate in benefits provided to full-time staff

- 457 Deferred Compensation Plans

But, on March 24, Whiteford Elementary School Principal Josh Tyburski sent a mass email and a payroll deduction form to school staff asking them to contribute to the levy. He used his school email account and wrote:

“We have had some great success with our fundraising efforts. Vendors have been very supportive with financial support. Contributions from all of our employee groups have had a significant impact on the campaign. If you have not already done so please consider contributing in any capacity that you can at this time.

“I’ve attached the payroll deduction authorization and you can always write a check to Committee for Sylvania’s Future and send directly to Laura Sauber.

- The levy committee needs to raise $60,000 for the campaign

- Funding sources include: vendors that work with the district, booster clubs, and contributions from employees and community members.

- Contributions can be for any amount.”

A review of the campaign finance reports for the levy show a large number of contributions from district staff that coincide with the pay dates.

Ohio Watchdog tried to ask School Board President Jim Nusbaum about the email and the payroll deductions, but he did not respond to requests for comment.

This isn’t the only email problem for the school district. Ohio Watchdog previously reported school staff was using school emails to solicit levy support from parents.

Staff advertised the levy on their official website and distributed pro-levy yard signs from their buildings.

Superintendent Brad Rieger said he was “responsible for everything,” though he was not disciplined by the school board.

“I have discussed these issues and my desire for training with Dr. Rieger and expect he will address these matters appropriately,” Nusbaum wrote in an earlier email to Ohio Watchdog.