Kansas think tank argues truth being twisted in deficit warnings

By Travis Perry │ Kansas Watchdog

OSAWATOMIE, Kan. — Words can be a tricky thing, with different meanings in different scenarios.

Take, for example, the word “deficit.” Now, nearly anyone can tell you what it means in reference to, say, the federal government. And most who know the basics of the Kansas Constitution will tell you the state is forbidden from running a fiscal deficit.

But you wouldn’t know that listening to the political chatter as of late.

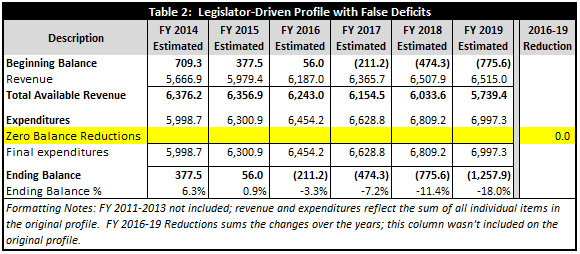

Sunflower State Democrats have been hollering about a looming $1.2 billion deficit for Kansas by 2019. The same figure has been repeated by the Kansas Values Institute and Democratic gubernatorial candidate Paul Davis.

But Dave Trabert, president of the conservative Kansas Policy Institute, argues such claims are misleading at best, and utter lies at worst.

“There really aren’t deficits, I think you’re probably aware of that, because constitutionally we can’t go below zero,” Raney Gilliland, Kansas Legislative Research Department director, told Kansas Watchdog.

Trabert outlined his case in a recent KPI blog post Thursday, and said the root of the issue is a fiscal breakdown prepared by KLDR for Sen. Laura Kelly, D-Topeka.

The KLRD profile being used by legislators to make false claims about deficits was produced “at the request and direction of a legislator and does not follow standard KLRD methodology.” Gilliland attributes this profile to Kelly and contacted her “…to ask for permission to release the profile we had done for her.…she requested that you contact her to get the profile you are requesting.” Kelly hasn’t responded to that request.

Trabert said Kelly’s assertion, outlined in the above table, is misleading because it doesn’t account for annual fiscal adjustments necessary to maintain a zero balance. When a household budget gets tight, people ratchet-back their spending, and Trabert said the state does the same thing.

“It’s certainly spreading falsehoods,” Trabert told Kansas Watchdog. “I’d say it’s done for political purposes. When you tell people that $1.2 billion will have to be cut, or taxes increased to that magnitude, it’s my opinion that’s done to try and scare people into saying ‘we need to do something different.’ It’s simply not giving people the facts.”

“Adjustments do need to be made … but adjustments would have needed to be made regardless,” he added.

Instead, Trabert points to a pair of possible solutions in the following tables. One option involves $482.3 million in reductions from fiscal year 2016 through fiscal year 2019, while the second focuses on a single, large-base expenditure reduction of $315 million in FY2016. Either way, he said, it’s a far from $1.2 billion.

Gilliland, however, takes issue with Trabert’s multi-year reduction suggestion.

“We would never have totaled it that way,” Gilliland told Kansas Watchdog.

While KLRD agrees there can be no budget deficits, Gilliland maintains the required expenditure reductions are not the $482.3 million sum of the annual changes in the May 30 profile, but the larger amount of $1.258 billion. To get there, he counts the annual reductions in Table 1 not just in the year made, but every year thereafter.

However, Trabert argues the solution is to simply make reductions to base costs, which wouldn’t carry from year-to-year as Gilliland said. Pointing to the Kansas Public Employee Retirement System, Trabert said reducing overall pension costs would give the entire state budget a little more headroom moving forward. Other reductions would be in the same vein.

However, Trabert argues the solution is to simply make reductions to base costs, which wouldn’t carry from year-to-year as Gilliland said. Pointing to the Kansas Public Employee Retirement System, Trabert said reducing overall pension costs would give the entire state budget a little more headroom moving forward. Other reductions would be in the same vein.

“It’s not about cutting services, it’s about providing those services at a better price,” Trabert added.

“This is a controversial issue, and so I expect it will continue to be,” added Gilliland.

Like Watchdog.org? Click HERE to get breaking news alerts in YOUR state!