Despite tax cuts, North Dakota revenues continue to soar

By Rob Port | Watchdog.org North Dakota Bureau

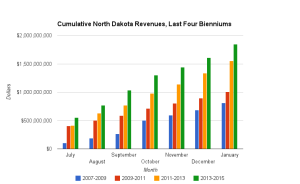

ROARING REVENUES: North Dakota’s revenue growth continues its record-setting pace. Chart created by Watchdog based on Office of Management and Budget revenue reports.

BISMARCK, N.D. — It seems not even tax cuts can put a damper on exploding tax revenues in North Dakota, where strong agriculture years and an ocean of oil in the western part of the state have driven record-setting population and economic growth.

According to the latest revenue numbers from the state Office of Management and Budget, biennium to date the state is up nearly $300 million in tax collections over the 2011-2013 biennium. That’s a 19.2 percent increase.

Compared to the 2009-2011 biennium, revenues through January are up a whopping 84 percent, or $844.5 million dollars.

The biggest source of revenue increases comes from the sales tax, which is up more than $133 million compared to the past biennium. The income tax is the second biggest source of increases, with collections from the corporate tax up $37.3 million and collections from the individual income tax up nearly $89.6 million through January.

Those revenue increases come despite aggressive cuts to the corporate and personal income taxes since the 2009 legislative session.

In 2008, voters defeated a ballot measure backed by the state chapter of Americans for Prosperity, which would have reduced state income tax rates by 50 percent, and corporate income tax rates by 15 percent. But starting in 2009, legislators have, in successive sessions, implemented a series of more modest cuts that have reduced corporate and personal income tax to below where the 2008 measure would have set them.

Despite the reductions, income tax revenues have boomed. Personal income tax collections are up nearly 74 percent, going from $173 million in January 2010 to $301 million though January 2014. Corporate income tax collections are up 171 percent, going from $36 million in January 2010 to $99 million through January 2014.

Revenues in the current biennium also continue to come in well above forecasts used by the North Dakota Legislature to budget, something that has drawn criticism from Democrats, though to date the projections are proving more reliable than in the last biennium.

In January 2012 the variance between actual revenues and the forecast was 28.5 percent, or more than $344 million.

In the current biennium through January, the variance is 8.9 percent, or $151 million.

You can reach Rob Port at rport@watchdog.org

The post Despite tax cuts, North Dakota revenues continue to soar appeared first on Watchdog.org.