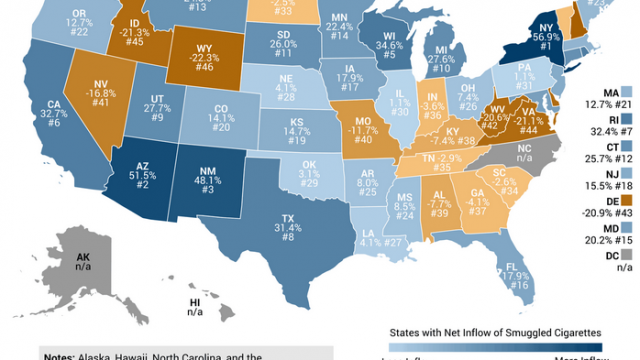

North Dakota Is A Net Exporter Of Smuggled Cigarettes

The map above was created by the Tax Foundation based on a study conducted by the Mackinac Center for Public Policy. It ranks the states by the amount of percentages of cigarettes consumed that are the result of smuggling.

As you can see, North Dakota is a net exporter of smuggled cigarettes, which isn’t that surprising given that the state is bordered by three others that have a) have per-pack taxes that are more than triple North Dakota’s and thus b) are net importers of smuggled cigarettes.

It can be lucrative. Assuming equal prices for the cigarettes themselves, you could buy 1,000 packs of cigarettes in North Dakota for $440 in taxes and drive across the border to Minnesota, where taxes would be $1,230 and sell them for a profit of $790.

Frankly, it’s probably geography that’s holding North Dakota back from exporting even more cigarettes. Aside from the border with Minnesota, there aren’t a lot of population centers near North Dakota’s borders to make cigarette smuggling easy. And aside from East Grand Forks and Moorhead, western Minnesota has a relatively sparse population.

But taken as a whole, the relationship between cigarette import/export states is a study in why high tax rates are generally ineffective as policy.

Again, via the Tax Foundation, here’s a chart showing the relationship between higher cigarette taxes and higher rates of smuggling:

We see the same relationship in migration patterns between high-tax and low-tax states. People tend to move from high-tax states and toward low-tax states.

The same is also true of the national tax rate. Through high taxes and low taxes, federal tax revenues as a percentage of GDP have stayed relative static for decades at about 17-18% of GDP, never going above 20% of GDP.

When US taxes get higher, people change their behavior to avoid taxes through things like legal tax shelters, or illegal tax avoidance. Higher taxes generally don’t work as policy because, once you go beyond a certain level of taxes, you reach a point of diminishing returns because people are going to do whatever they can to avoid them.

Just like smokers will smuggle cigarettes, and taxpayers will move, if taxes get too high.