Chambers: Churches should pay property taxes

By Deena Winter | Nebraska Watchdog

LINCOLN, Neb. – Omaha Sen. Ernie Chambers used Bible verses to argue for his bill that would require churches to start paying property taxes in Nebraska.

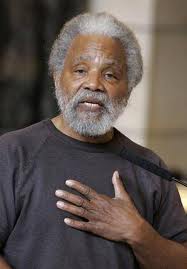

Sen. Ernie Chambers

Chambers noted that the governor and candidates for governor have said “everything should be on the table” with regard to tax reform, and so he put his sure-to-be-controversial proposal squarely on the table. The Revenue Committee held a public hearing on the bill Friday, which attracted just two people: One a secularist who supported the bill; the other a spokesman for the Catholic Church who opposed it.

Chambers argued that if churches, cathedrals and temples paid property taxes, the state could reduce funding to local governments and schools. He said there are nearly 3,000 churches in the state which have “a tremendous amount of property” and quoted Jesus, who said, “Render unto Caesar what is Caesar’s.”

“In short, pay your taxes,” Chambers said. “This bill just carries out what Jesus wanted his followers to do.”

While he said he doesn’t begrudge “church people coming here and bending our ear” on issues, they ought to “get in the game” and pay taxes since they often “clamor louder than any other group.”

Sen. Beau McCoy, R-Omaha, asked whether Chambers was familiar with the case Walz vs. the New York Tax Commission, in which the U.S. Supreme Court upheld property tax exemptions for churches in 1970.

Chambers said the Supreme Court did not dictate that Legislatures must grant property tax exemptions to churches.

“The Legislature put it in the statute, the Legislature can take it out,” he said.

McCoy pulled out a Bible verse, too: Ezra 7:24, which says, “You are also to know that you have no authority to impose taxes, tribute or duty on any of the priests, Levites, musicians, gatekeepers, temple servants or other workers at this house of God.”

But Chambers dismissed that as Old Testament, saying “Jesus came to set aside the law. He changed it. That’s why it’s called the New Testament.”

He noted that McCoy doesn’t adhere to some Old Testament commands regarding garments and resting on the Sabbath.

“The Bible is like a Walmart, you go from shelf to shelf and take what you want,” Chambers said.

Later in the hearing Chambers said churches are “really financial institutions masquerading as churches.”

“That’s one of the best hustles in the world,” he said.

His bill was supported by Justin Evertson of the 1-year-old group called Secular Coalition for Nebraska, which represents about 300,000 Nebraskans who identify themselves as non-religious. He called property tax exemptions for religious organizations a clear violation of the separation of church and state.

“We think it’s time to have this debate, to have this discussion,” he said, acknowledging that while the bill is unlikely to pass, “maybe you pick off pieces that deserve to be taxed.”

The bill was opposed by Jim Cunningham, executive director of the Nebraska Catholic Conference. He asked the committee to indefinitely postpone, or kill, the bill, saying it would end a sound, century-old policy that recognizes how religious groups serve the common good.

“Churches are not just ongoing associations of faith and spirituality, they are anchors,” he said. Church members already pay taxes, and many churches would be “greatly burdened” if they had to pay property taxes, he said.

“The power to tax is, in the long run, the power to control or suppress,” Cunningham said.

That prompted Chambers to give a lengthy extended speech about the sexual abuse problems in the Catholic Church. Getting back to the bill, he said all you have to drive around to see that churches put on an “ostentatious display of wealth.”

“They can afford it,” he said.

Contact Deena Winter at deena@nebraskawatchdog.org. Follow Deena on Twitter at @DeenaNEWatchdog

Editor’s note: to subscribe to News Updates from Nebraska Watchdog at no cost, click here.

The post Chambers: Churches should pay property taxes appeared first on Watchdog.org.