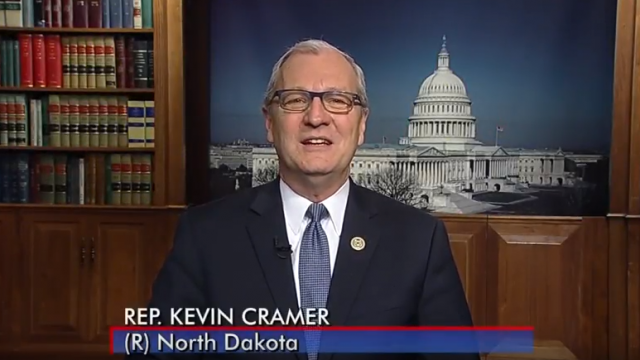

Rep. Kevin Cramer: Tax Cuts Benefit Everyone, Especially the Middle Class

While Americans hung their stockings by the chimney with care, Congress worked diligently to reconcile the differences between the House and Senate tax bills. The result is final passage of the Tax Cuts and Jobs Act, which promises to keep Uncle Sam far from the holiday spoils.

Congress’ bill is a win for our state. First and foremost, the standard deduction – which 82 percent of North Dakotans claimed according to 2014 returns – doubles to $12,000 for individuals and $24,000 for families. Under this provision alone, a family earning the state’s median household income of $59,000 would pay no federal tax on almost half of their wages.

Coupling these changes with a reduction to the 12 percent income tax bracket, you’ll find that the vast majority of earners in North Dakota will see far less of their earnings sent to Washington. And with the bill making it to President Trump’s desk before Christmas, the IRS projects that taxpayers will see less money withheld from their paychecks as early as February 2018.

In addition to increasing take home pay, the tax cuts will give local businesses greater flexibility to reinvest in themselves and their community. The final bill allows small businesses to deduct 20 percent of their income, dropping the top tax rate for North Dakota’s 73,021 small businesses from 39.6 percent down to 29.6 percent. Another provision allows small businesses to write off capital investments and accrued interest. Tax cuts like these will help small business owners address some of their primary concerns: repaying debt so they can focus on expanding, hiring, and retaining good employees with higher wages.

[mks_pullquote align=”right” width=”300″ size=”24″ bg_color=”#ffffff” txt_color=”#000000″]…those who broadly oppose any policy championed by representatives with an “R” beside their name are playing the same old song and dance, calling the bill a tax break for the wealthy.[/mks_pullquote]

The Tax Cuts and Jobs Act takes care of our farmers by expanding the Section 179 expensing of equipment, doubling the death tax exemption, and maintaining the step-up in basis for capital gains. And it supports farm cooperatives by including the Hoeven-Thune amendment to allow for a 20 percent tax deduction at the entity and member level a solution I helped push through the House of Representative that compensates farmers for the elimination of the Section 199 deduction.

When you consider that 98.8 percent of businesses in our state are small businesses, it’s easy to see what a far-reaching impact this plan will have on working families. Yet several under-reported aspects of the bill ensure that its positive impacts extend beyond the lifespan of any one cut.

The compromise bill also incentivizes scholarship and innovation by maintaining the tax graduate school tuition waivers, and reinstating deductions for student loan interest and private research and development. Just as value-added agriculture, technological advancements in oil and natural gas extraction, and an expanding tech sector helped position North Dakota as the nation’s first in economic growth, so too does the success of the American economy depend on the ingenuity and education of its next generation.

Yet those who broadly oppose any policy championed by representatives with an “R” beside their name are playing the same old song and dance, calling the bill a tax break for the wealthy.

When three Senate Democrats spread a talking point that the Republican plan would raise taxes on the middle class by about $800, even The Washington Post – hardly a bastion for conservative thought – gave the Senators four out of four “Pinocchios” in its fact check analysis. The Post found that more than 97 million households and every group of income earners, on average, will receive a tax cut.

In this time of political division, we should acknowledge the bill’s strengths and the compromises necessary to pass sweeping tax cuts for the middle class. For instance, legislators increased the top corporate tax rate to 21 percent, higher than originally proposed in either the House or Senate and far higher than Trump’s initially requested 15 percent rate, in order to make the deal work.

This tax bill isn’t perfect hardly any legislation is. But putting money back into local economies where it belongs is the best Christmas gift Washington can give, and I was glad to support Congressional Republicans and President Trump in bringing tax cuts to the people of North Dakota.