Rep. Rick Becker: In Defense Of Eliminating The Income Tax

North Dakota is awash in money. Due primarily to oil revenue, our state is enjoying great prosperity. Our coffers are overflowing.

In line with conservative thought, we have planned ahead and have funds for future needs. Those funds, however, are flush with money to the point that we have created (and possibly are still creating) even more funds, and now those funds are flush with money as well.

Also consistent with conservative thought is to tax only what is necessary for the government to function in it’s proper role. We have moved well beyond that point. It’s time for the state to take in less money.

Taking in tax dollars in any format, and redistributing them via various programs, subsidies, and buy-downs is far less beneficial for the economy than to simply allow the citizens of North Dakota to keep their money, and to spend and invest it as they see fit. Additionally, in the process of accumulating and spending all that tax money, the size of state government and the largesse of the state continue to grow at an unprecedented rate.

A wise fellow legislator recently wrote to me, “What I really know about taxes is the more we collect, the more we spend. That’s about as simple as it gets.”

Exactly!

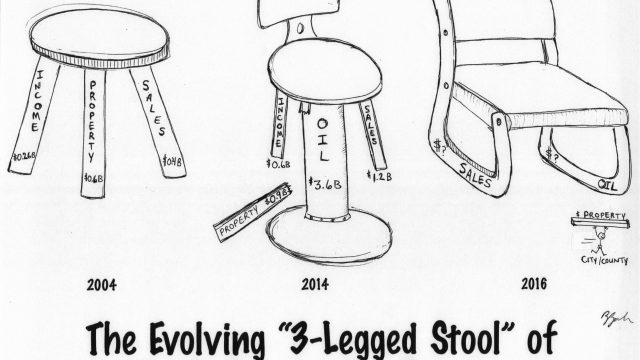

We need to look seriously at how we can decrease the money we take from our citizens. In doing so, we need to deconstruct the now-illegitimate analogy of the “three-legged stool”. That analogy, used for decades, suggests that in order to run government, we need the three legs of taxation to support it; income tax, sales tax, and property tax. Remove one of the sources of tax revenue, and the government can’t stand. The analogy was previously useful. You certainly couldn’t remove one of the legs without bolstering one of the others.

Today, however, it is an entirely different landscape. Revenue from oil taxes is now a fourth leg, one might say a center pedestal, providing a great deal of support, and rendering the three-legged stool concept obsolete.

Continuing the analogy, if we are going to build a chair befitting the economy of North Dakota today, what does it look like?

First, we need to address the fact that the analogy does not discern state government from local government. They are two different animals, and should each have their own chair. Property tax doesn’t belong on the state’s chair. It’s rightful place is as part of the local government entity’s chair. The ever-increasing state buy-down of property taxes is a mistake in my opinion, but that thought requires it’s very own discussion. Let it suffice to say the Property Tax leg of the stool is broken. That revenue supports local government, and really doesn’t belong on the stool of state government as a support necessary to function. Let’s take it off and give it to the locals for their chair. It needs some major reform, true (hopefully addressed this session), but let’s keep it where it belongs.

That leaves three primary options; Oil Taxes, Sales Tax, and Income Tax. Oil taxes are most likely appropriate right where they are. There is no appetite to decrease them, and increasing them runs the risk of choking the Golden Goose. Sales tax is likely the fairest method of taxing we currently employ.

It’s at a moderately low rate, and brings in a substantial amount of revenue. I attempted to lower the sales tax last session, but that really didn’t have any legs. Very good arguments have been made to lower the state sales tax, and allow local subs to institute or increase a local sales tax. This would be a much better way to accomplish the goals intended by the state buying down property tax. Nevertheless, aside from some possible tweaks, it should remain as a primary support of state government.

That leaves income tax.

As a philosophically unshakeable fiscal conservative and a rookie in the legislature, I was a bit dumbfounded by the lack of interest in Rep. Louser’s moratorium on income tax. I think I understand a little better now. It’s understandable that there is trepidation to eliminate a support, which has been there for so long. Perhaps there were specifics in that bill, which won’t be in the new bill(s), that caused some consternation. One of the big hang-ups for support is that there isn’t a clamoring of calls from constituents to eliminate the income tax.

That may be true, but our job as legislators is much more than responding to complaints.

Firstly, we know that by eliminating the personal and corporate income tax, about $1.5 billion dollars per biennium will remain in the pockets of the citizens of North Dakota. They will spend it and invest it to the distinct benefit of all North Dakotans, as it drives our economy to even greater prosperity. Secondly, we know that if we don’t eliminate it, State government will continue to grow, and more unnecessary pots of money will need to be invented to hold more money.

This is a slam-dunk for the conservative. Now is the time to eliminate the income tax.